Pan-European dairy cooperative Arla Foods says border breakdown could leave UK consumers with less choice and higher prices

At an event held today at the London School of Economics (LSE), pan-European dairy cooperative Arla Foods will warn that if the findings of a LSE report prove true, non-tariff barriers to trade and restricted access to labour after Brexit will leave British consumers facing a dairy dilemma which could see the availability of butter, yoghurts and cheese become restricted.

The Government’s White Paper on the UK’s future relationship with the EU sets out proposals to ease trade between this country and Europe. But this is still to be agreed with the EU, and as is identified in the report from the LSE, The impact of Brexit on the UK dairy sector, any friction and any limitations on access to key skills will mean that UK consumers pay the price through less choice, higher prices, and potentially lower food standards.

Arla Foods will today say that the issues identified in the LSE report mean a dairy dilemma in the UK, with three possible outcomes:

- That it will become much more difficult to import dairy products from Europe, leading to a shortage both of dairy staples and particularly of products such as speciality cheeses, where domestic supply is constrained by limited production capacity in an already tightly managed supply chain.

- Escalating pressure on costs, and ultimately increased consumer prices for dairy goods. Current dairy imports include cheese, butter, butteroil, whey, buttermilk and fermented products, yoghurt, concentrated milk, powders, milk and cream, infant formula and ice cream meaning that the impact could be widespread.

- That ways are found somehow to ramp-up production and cut farm costs, which in the short-term at least would inevitably undermine the world-leading standards of our dairy industry – something neither farmers nor consumers would accept.

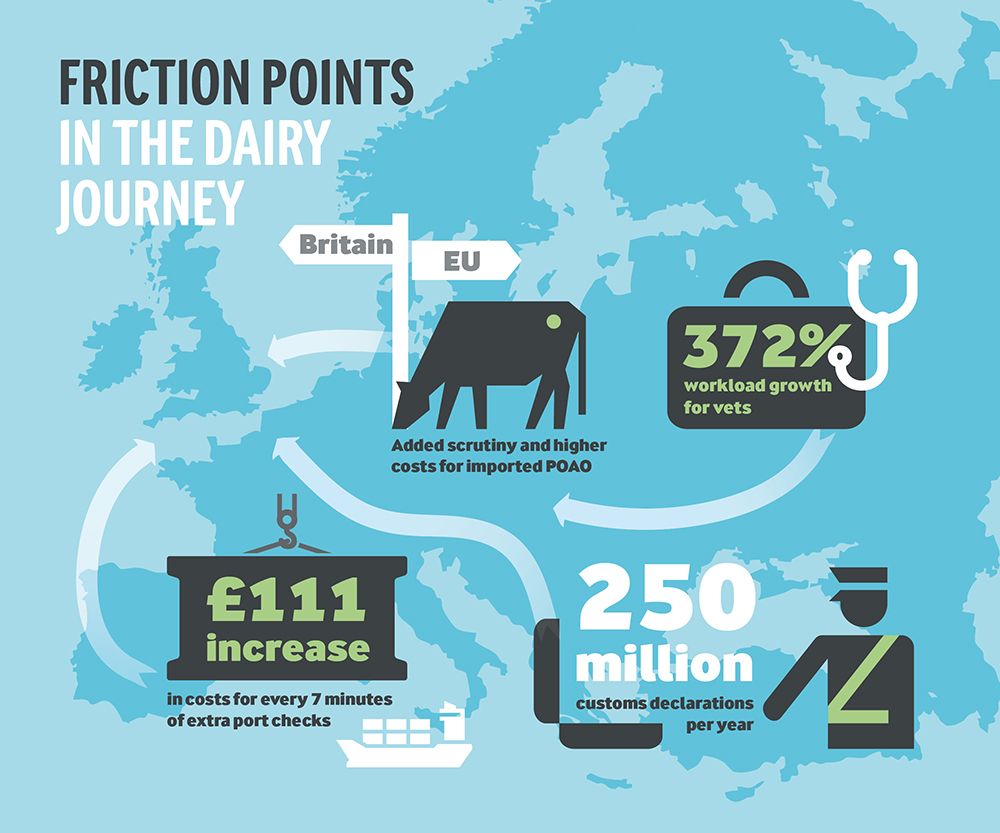

This is in addition to costly impacts throughout the supply chain, problems that could be exacerbated by a shortage of vets, lorry drivers and farm workers post-Brexit. Amongst the issues caused by non-tariff barriers and unavailability of key labour the report identifies:

- Increased times for customs inspections at UK ports, with even a seven-minute additional waiting period for each inspection adding 10 hours of delays and additional costs of at least £111 per container.

- Risks of additional delays thanks to asking the UK’s new Customs Declaration Service, designed to handle only 150 million declarations per year, to handle the more than 250 million expected post-Brexit.

- Further additional costs due to subjecting products of animal origin (POAO) such as dairy to checks at the border – if, indeed, border posts are equipped to do such checks at all.

- A particularly acute challenge caused by increased veterinary checks at the same time as the number of vets decreases as a result of Brexit, leading to a growth in workload of 372 per cent for vets at the border – with “no certainty that the system will continue to function adequately given these additional pressures”.

- Rising costs as EU national lorry drivers and farm workers return home due to the fall in the value of the pound and other Brexit-related issues.

Arla Foods UK, the country’s leading dairy company and part of a pan-European cooperative owned by around 11,000 farmers, has previously noted that a hard Brexit without a trade deal could have a disastrous impact on this country’s dairy industry and its consumers. The probability of the UK and the EU reaching a deal in their negotiations seems to change every day, but this report makes clear that even with an agreement over trade and a ‘softer’ departure from the European Union these major issues remain, posing a dilemma for the British dairy industry at large.

Ash Amirahmadi, UK Managing Director, Arla Foods UK comments: “The farmers that own the Arla dairy cooperative already balance keeping consumer prices down with maintaining quality and the best standards, including high animal welfare. There’s no margin to play with here in the value chain. Any disruption means that if we don’t get the practicalities of Brexit right we will face a choice between shortages, extra costs that will inevitably have to be passed on to the consumer or undermining the world-class standards we have worked so hard to achieve.”

Setting the context for the LSE report is the fact that the UK has the second largest dairy trade deficit in the world, at up to 16 per cent (98 per cent of our dairy imports are of EU origin). That heavy reliance on EU imports means that any problems at the border post-Brexit and shortages of labour in key areas are likely to have a major, and predominantly negative, impact on the domestic market in the form of shortages of products and significantly higher prices.

Ash Amirahmadi continues: “Our dependence on imported dairy products means that disruption to the supply chain will have a big impact. Most likely we would see shortages of products and a sharp rise in prices, turning every day staples, like butter, yoghurts, cheese and infant formula, into occasional luxuries. Speciality cheeses, where there are currently limited options for production, may become very scarce.

“It is important to be clear about this: Brexit might bring opportunities to expand the UK industry in the long term, but in the short and medium term we cannot just switch milk production on and off. Increasing the UK’s milk pool and building the infrastructure for us to be self-sufficient in dairy will take years.”

“To protect the British public we are calling on both sides in the negotiations to be pragmatic and sensible as they address the practicalities of Brexit, allowing us to have frictionless customs arrangements and ready access to key labour in the years ahead.”